If you’re a driver in New Jersey, finding cheap auto insurance is likely a top priority. With high population density, busy highways, and strict insurance laws, car insurance rates in the Garden State can be higher than the national average. However, with the right strategies and knowledge, you can secure affordable coverage without compromising on protection.

In this article, we’ll explore how to find cheap auto insurance in New Jersey, what factors affect your premiums, and which companies offer the best deals.

Why Auto Insurance Is Expensive in New Jersey

Before diving into how to save, it’s important to understand why car insurance tends to be more expensive in New Jersey compared to other states:

- High population density: More drivers on the road means a higher risk of accidents.

- Strict insurance laws: New Jersey is a no-fault state, which increases the cost of coverage.

- Litigation risk: The state has a high rate of auto-related lawsuits, which raises insurer costs.

- Urban driving: Many residents live in or near cities like Newark and Jersey City, where accident and theft rates are higher.

Despite these challenges, there are still ways to get cheap car insurance in New Jersey by shopping smart and knowing what discounts are available.

Minimum Auto Insurance Requirements in New Jersey

To drive legally in New Jersey, you must carry at least the minimum liability coverage. There are two main types of policies:

- Basic Policy:

- $10,000 for property damage liability per accident

- $15,000 in personal injury protection (PIP)

- Optional: $10,000 bodily injury liability per accident

- Standard Policy:

- Bodily injury liability: $25,000 per person / $50,000 per accident (minimum)

- Property damage liability: $25,000 per accident

- Personal injury protection (PIP): $15,000 minimum

- Uninsured/underinsured motorist coverage

While the basic policy is cheaper, it offers limited protection. Opting for a standard policy gives you broader coverage and more peace of mind, often at a slightly higher cost.

How to Find Cheap Auto Insurance in New Jersey

1. Compare Quotes from Multiple Providers

The number one rule for saving on car insurance is to shop around. Rates can vary significantly between companies, even for the same driver profile. Use comparison websites or work with an independent insurance agent to review multiple quotes.

2. Bundle Policies

Many insurance companies offer discounts when you bundle your auto insurance with homeowners, renters, or life insurance policies. This can save you anywhere from 10% to 25%.

3. Take Advantage of Discounts

Ask your insurer about available discounts. Some common options include:

- Safe driver discount

- Good student discount

- Military or veteran discount

- Low mileage discount

- Anti-theft device discount

- Paperless billing or autopay discount

4. Choose a Higher Deductible

Raising your deductible — the amount you pay out of pocket in a claim — can lower your premium. Just be sure you can afford the deductible if you ever need to file a claim.

5. Maintain a Clean Driving Record

Your driving history significantly affects your premium. Avoiding accidents, tickets, and DUIs can lead to lower rates and qualify you for safe driving discounts.

6. Use Usage-Based Insurance (UBI)

Many insurers offer telematics programs that track your driving habits using a mobile app or a device installed in your vehicle. If you’re a safe driver, these programs can reward you with significant savings.

7. Improve Your Credit Score

In New Jersey, insurers are allowed to use your credit score to determine your rate. A higher credit score can lead to lower premiums, so pay bills on time and reduce outstanding debts.

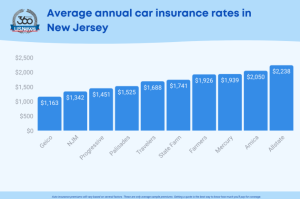

Top Companies for Cheap Auto Insurance in New Jersey

Here are some of the top-rated insurers offering affordable auto insurance in New Jersey:

1. Geico

Geico consistently offers some of the lowest rates in the state, especially for drivers with clean records. Their mobile app and customer service are also highly rated.

2. Progressive

Progressive offers competitive pricing, a wide range of discounts, and the Snapshot UBI program for additional savings.

3. New Jersey Manufacturers (NJM)

NJM is a local insurer known for its excellent customer service and low rates for good drivers. It’s especially popular among residents who prefer personalized service.

4. State Farm

With a large network of agents across the state and numerous discount options, State Farm is a reliable choice for affordable coverage.

5. Allstate

Allstate offers a variety of policy options and helpful tools like Drivewise, a UBI program that rewards safe drivers.

Best Cheap Auto Insurance for Specific Driver Types

Here’s a breakdown of which companies may offer the best rates based on different driver profiles:

- Young drivers: Geico, Progressive, and State Farm

- Senior drivers: NJM and AARP/The Hartford

- Drivers with accidents: Progressive and Allstate

- Low-mileage drivers: Metromile (pay-per-mile insurance)

FAQs About Cheap Car Insurance in New Jersey

Q: Is it legal to drive with just the basic policy in New Jersey?

A: Yes, but it provides limited coverage. If you can afford it, a standard policy is recommended for better protection.

Q: What’s the average cost of car insurance in New Jersey?

A: As of 2025, the average annual premium for full coverage is around $1,700, while minimum coverage averages $900. Rates vary by location, driving history, and vehicle type.

Q: Can I get cheap car insurance with bad credit?

A: Yes, but it might be harder. Focus on insurers that weigh credit less heavily, and look for discounts to offset higher premiums.

Q: Does New Jersey offer low-income car insurance?

A: Not officially, but some insurers offer budget-friendly policies tailored to lower-income drivers. NJM and Geico may be good starting points.

Final Thoughts

Finding cheap auto insurance in New Jersey is possible with the right approach. Compare quotes regularly, maintain a clean driving record, and ask for discounts. Whether you’re a new driver in Newark or a long-time resident in Trenton, there are plenty of ways to save while staying protected on the road.