When shopping for insurance, many people notice a significant price difference between homeowners insurance and renters insurance. This often raises the question: why are the premiums for homeowners insurance more expensive than those of renters insurance? The answer lies in the differences in coverage, responsibility, property value, and risk factors involved. In this article, we’ll explore the key reasons for the cost disparity and help you better understand how these two types of insurance function.

What Is Homeowners Insurance?

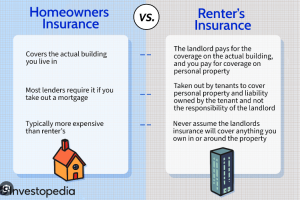

Homeowners insurance is a type of property insurance that provides financial protection for your home and belongings in the event of damage, theft, or liability. A standard policy typically covers:

- The physical structure of the home

- Detached structures like garages or sheds

- Personal belongings

- Liability for injuries on your property

- Temporary living expenses if your home is uninhabitable due to covered damage

What Is Renters Insurance?

Renters insurance, on the other hand, is designed for people who rent their living space. Unlike homeowners insurance, renters insurance does not cover the building itself. Instead, it covers:

- Personal belongings inside the rental

- Liability in case someone is injured inside your unit

- Additional living expenses if you’re temporarily displaced

Since the renter does not own the physical structure, the landlord is responsible for insuring the building itself.

Key Reasons Why Homeowners Insurance Is More Expensive

1. Coverage of Property Structure

The most significant reason homeowners insurance is more expensive is because it includes coverage for the actual structure of the home. If your house burns down or is severely damaged by a natural disaster, your policy will cover rebuilding or repair costs. This structural coverage accounts for the largest portion of a homeowners insurance premium.

In contrast, renters insurance only covers personal belongings and liability—not the building. The landlord’s insurance handles the structural protection, which dramatically reduces the renters insurance premium.

2. Replacement Cost Value

Homeowners insurance often includes replacement cost coverage, which pays to rebuild your home with materials of similar kind and quality at current prices. As construction costs continue to rise due to inflation and labor shortages, insurance companies must increase premiums to reflect this higher potential payout.

Renters insurance also offers replacement cost options for personal belongings, but the value of furniture, electronics, and clothing is usually far less than the cost to rebuild an entire home. This makes renters insurance much cheaper by comparison.

3. Greater Risk and Liability

Owning a home comes with more responsibility—and therefore, more liability. For example, if someone slips on your icy driveway and sues you, your homeowners policy could be required to pay legal fees and settlement costs. Pools, trampolines, dogs, and other features also increase liability exposure.

Renters face liability risks too, but to a lesser extent. Since they don’t own or maintain the property, they have fewer opportunities to be held responsible for structural issues. This lower risk translates into lower premiums.

4. Natural Disaster Coverage

Homes in areas prone to natural disasters—like hurricanes, wildfires, or earthquakes—are typically charged higher premiums. The cost to repair or replace a house damaged by natural events can be enormous, so insurers price accordingly.

Renters insurance, while it can offer coverage for personal items damaged by certain disasters, does not need to account for structural damage. This significantly lowers its risk profile.

5. Dwelling Size and Location

Another reason why homeowners insurance is more expensive than renters insurance is the size and value of the dwelling. Larger homes in high-value neighborhoods cost more to insure due to their higher replacement costs. Additionally, premiums can vary depending on:

- Proximity to fire stations

- Local crime rates

- Regional weather patterns

- Building materials used

While location also affects renters insurance, it plays a less substantial role since only personal property is covered.

6. Mortgage Lender Requirements

Many mortgage lenders require homeowners to carry a specific level of insurance, often with additional coverage such as flood insurance or private mortgage insurance (PMI). These added layers can increase the cost of coverage.

Renters insurance is optional in most cases, though some landlords do require tenants to purchase it. Even when required, the amount is minimal and generally more affordable.

7. Maintenance and Upkeep

Homeowners are responsible for maintaining their property, including the roof, HVAC system, plumbing, and electrical systems. Poor maintenance can increase the likelihood of claims, which leads to higher premiums over time.

Renters, by contrast, are not held accountable for these systems, as they are maintained by the landlord. As a result, renters insurance typically involves fewer claims, contributing to lower costs.

Comparing Average Premiums

According to data from the Insurance Information Institute, the average annual premium for homeowners insurance in the U.S. is about $1,428, while the average cost of renters insurance is around $180 per year. This stark contrast highlights how much more financial responsibility homeowners carry.

How to Reduce Insurance Premiums

If you’re concerned about high premiums, here are some tips for both homeowners and renters:

For Homeowners:

- Increase your deductible

- Install home security systems

- Bundle your home and auto insurance

- Avoid small claims to keep your record clean

- Shop around for better rates

For Renters:

- Choose a higher deductible

- Shop for discounts (multi-policy, claim-free, etc.)

- Secure your apartment with smoke detectors and deadbolts

Conclusion

So, why are the premiums for homeowners insurance more expensive than those of renters insurance? It all comes down to the scale of coverage and responsibility. Homeowners insurance covers not only your belongings but also the physical structure of the house and liability risks, making it more comprehensive—and more costly.

Renters insurance, while still essential for protecting personal items and liability, is far more limited in scope. Understanding these differences can help you make informed decisions when purchasing insurance and ensure you’re adequately protected based on your living situation.

Whether you rent or own, having the right insurance policy is crucial. Don’t just focus on cost—look at coverage limits, deductibles, and policy exclusions to ensure your peace of mind.