When it comes to investing and managing money, understanding the term “bonds” is essential. Bonds are a fundamental part of the financial world and play a vital role in global economies. If you’re new to finance or looking to diversify your investment portfolio, knowing what bonds are, how they work, and why they matter is crucial. In this article, we will explain the meaning of bonds in finance, explore their types, benefits, risks, and their importance in the financial markets.

What Are Bonds in Finance?

In finance, a bond is a fixed-income instrument that represents a loan made by an investor to a borrower, typically a corporation or government. Think of bonds as IOUs. When you purchase a bond, you are lending money to the issuer in exchange for regular interest payments, plus the return of the bond’s face value when it matures.

Bonds are often used by companies, municipalities, states, and sovereign governments to finance projects and operations. The person who buys the bond is known as a bondholder, and the entity that issues the bond is called the issuer.

Key Components of a Bond

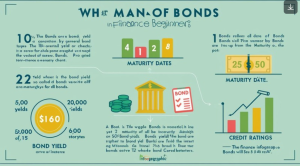

To understand how bonds work, it’s important to familiarize yourself with their basic components:

- Face Value (Par Value): The amount the bondholder will receive when the bond matures, typically $1,000 per bond.

- Coupon Rate: The interest rate the bond issuer will pay annually or semi-annually to the bondholder.

- Maturity Date: The date on which the issuer returns the principal amount to the bondholder.

- Issuer: The organization that borrows the money by selling bonds.

- Yield: The bond’s return based on its current price and coupon payments.

Types of Bonds in Finance

There are several types of bonds available in the financial markets. Each type serves a different purpose and comes with varying levels of risk and return.

1. Government Bonds

These are issued by national governments and are considered low-risk investments. For example, U.S. Treasury Bonds are among the safest bonds worldwide. Other examples include UK Gilts and Japanese Government Bonds.

2. Municipal Bonds

Municipal bonds are issued by states, cities, or other local governments to fund public projects like schools or roads. Interest earned on most municipal bonds is tax-free, making them attractive to investors in higher tax brackets.

3. Corporate Bonds

Issued by companies to raise capital, corporate bonds usually offer higher yields than government bonds due to higher risk. These can range from stable investment-grade bonds to high-yield or junk bonds.

4. Zero-Coupon Bonds

These bonds do not make periodic interest payments. Instead, they are sold at a discount and pay the full face value at maturity.

5. Convertible Bonds

Convertible bonds give the bondholder the option to convert the bond into a predetermined number of shares of the issuing company’s stock.

How Bonds Work in Finance

When you buy a bond, you are essentially lending money to the issuer in exchange for interest payments over a specific period. For example, if you buy a $1,000 bond with a 5% annual coupon rate, you’ll receive $50 each year until the bond matures. At maturity, you get your original $1,000 back.

Bonds are traded on both primary markets (where bonds are initially sold) and secondary markets (where investors can buy and sell existing bonds).

Why Investors Choose Bonds

1. Predictable Income

Bonds provide regular and predictable interest income, making them a popular choice for conservative investors or retirees.

2. Capital Preservation

Because most bonds return the full face value at maturity, they are a safe way to preserve capital—especially government bonds.

3. Portfolio Diversification

Adding bonds to an investment portfolio can reduce overall risk. They often move inversely to stocks, helping to balance market volatility.

4. Tax Advantages

Municipal bonds offer tax-free income, and some government bonds are exempt from certain taxes, depending on the country and bond type.

Risks of Investing in Bonds

While bonds are considered safer than stocks, they do carry certain risks:

1. Interest Rate Risk

When interest rates rise, bond prices usually fall. This happens because new bonds offer better returns, making older ones less attractive.

2. Credit Risk

The issuer might default on interest payments or fail to repay the principal. This risk is higher with corporate or junk bonds.

3. Inflation Risk

Inflation can erode the purchasing power of the bond’s fixed interest payments, especially over long periods.

4. Liquidity Risk

Some bonds are not actively traded and can be hard to sell quickly without a price loss.

How Are Bonds Rated?

Credit rating agencies like Moody’s, S&P, and Fitch assess the creditworthiness of bond issuers. Ratings range from AAA (highest quality) to D (default). Investment-grade bonds have ratings of BBB or higher, while bonds rated below BBB are considered high-yield or junk bonds.

Bonds vs. Stocks: What’s the Difference?

- Ownership: Buying stocks means owning part of a company; bonds are a form of debt.

- Returns: Stocks generally offer higher long-term returns but with more volatility; bonds provide stable income with lower risk.

- Priority: In the event of bankruptcy, bondholders are paid before shareholders.

Importance of Bonds in the Financial System

Bonds are a crucial part of the global financial system. They help governments fund infrastructure, corporations raise capital for expansion, and investors achieve financial goals through income and risk management. Bond markets are often seen as indicators of economic health. For example, when yields rise sharply, it could indicate inflation fears or economic instability.

How to Start Investing in Bonds

If you’re considering adding bonds to your portfolio, here are a few ways to get started:

- Buy individual bonds through a brokerage.

- Invest in bond mutual funds or ETFs for diversification.

- Consider laddering, a strategy that involves buying bonds with staggered maturities to manage interest rate risk.

- Research credit ratings and issuer reliability before investing.

Always assess your investment goals, risk tolerance, and time horizon before buying bonds.

Conclusion

Understanding the meaning of bonds in finance is essential for anyone looking to build a well-rounded investment strategy. Bonds offer stable returns, lower risk, and valuable diversification benefits. While they may not offer the same growth potential as stocks, they are a vital tool for income generation and capital preservation.